Welcome to The Future of Lending™.

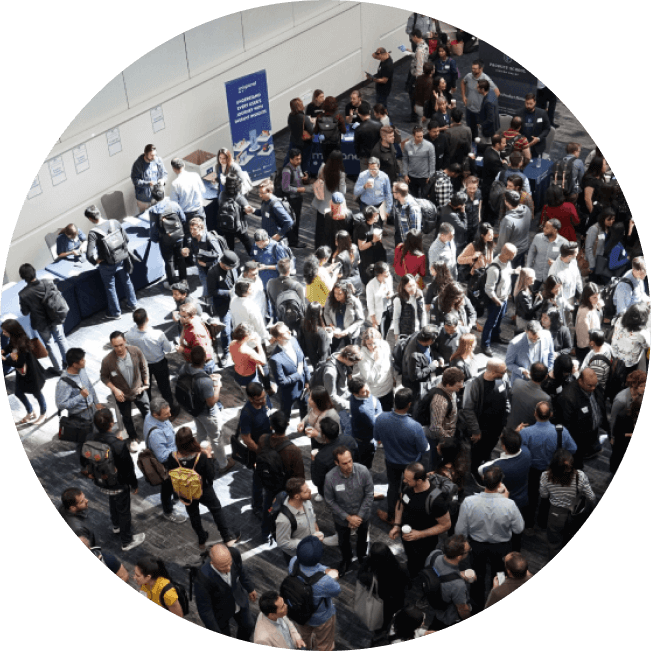

From banks and alternative lenders to best-of-breed vendor from the fintech ecosystem, the Summit is the hub for payment and lending innovation across all consumer and commercial sectors. On November 6th, 2024: network with over 800 industry executives. (See last year’s sold out event.) Download the sponsorship package here.

Draft Agenda

8:00 am - 6:00 pm

Network

Use the Summit App to setup meetings in the networking hall throughout the day. Schedule time in the network hall. Numbers in the app correspond with numbers on the networking area high tops.

Balancing Risk vs Reward as Rates Come Down

Analyze the delicate balance between risk and reward in a declining interest rate environment. This panel will explore strategies for maintaining profitability while managing credit risk, and offer insights into adapting lending practices to new market conditions.

The Emergence of Earned Wage Access

Workshop: Explore the growing trend of Earned Wage Access (EWA) and its impact on the financial landscape. This panel will discuss how EWA is transforming payroll, enhancing employee financial wellness, and the opportunities it presents for lenders and fintech companies.

Is Cash Flow Underwriting the Future of Credit Risk?

Examine the potential of cash flow underwriting as a more accurate measure of credit risk. Discover its advantages and challenges in the evolving lending landscape.

How to Take Advantage of AI Across Your Lending Business

Workshop: Understand how artificial intelligence (AI) can be utilized across various aspects of your lending business. Discover practical applications and success stories from industry experts.

How to Solve for Collection Amid Bankruptcy

Address the challenges of debt collection during bankruptcy proceedings. Learn effective strategies and solutions to navigate these complex situations.

Innovations in Business Lending

Workshop: Stay ahead with the latest innovations in business lending. This panel will showcase cutting-edge technologies and strategies that are transforming the sector.

Network Break

-

Sponsored by Kapcharge

How to Take Advantage of Creditor Insurance

Workshop: Discover the benefits of creditor insurance and how it can be leveraged to mitigate risks. This panel will cover best practices and innovative uses of this financial tool.

Banking-as-a-Service & Credit Card Issuing

Explore the concept of Banking-as-a-Service (BaaS) and its role in modern credit card issuing. Understand how this model can benefit both traditional banks and fintech companies.

The Future of POS Lending

Discuss the trends and technologies shaping the future of Point-of-Sale (POS) lending. Understand how this space is evolving and what it means for merchants and consumers alike.

How to Compete for and Win High-Quality Leads

Workshop: Explore strategies for attracting and securing high-quality leads in the competitive lending market. Learn from industry leaders about effective marketing and acquisition techniques.

Raising Credit Facilities as Rates are in Flux

Gain insights into strategies for raising credit facilities amidst fluctuating interest rates. Experts will share their experiences and best practices for navigating these challenges.

Real-time Identity Verification & Fraud Detection

Workshop: Explore the latest advancements in real-time identity verification and fraud detection technologies. Learn how banks and fintechs can collaborate to safeguard transactions and ensure a seamless customer experience.

Choosing Payment Rails to Improve Repayment

Learn how selecting the right payment rails can enhance repayment processes. This panel will highlight various options and their impact on efficiency and customer satisfaction.

Details

Date

November 6th, 2024

Time

8:00 am – 6:00 pm

Venue

The Quay, 100 Queens Quay E 3rd Floor, Toronto, ON M5E 1V3

Sign up for our newsletter

Join over 5 thousand fintech and lending executives who read our monthly news briefing.